Chase Car is below to assist you to get the proper motor vehicle. Submit an application for vehicle financing for any new or utilised car or truck with Chase. Make use of the payment calculator to estimate monthly payments. Check out the Chase Car Education and learning Heart to receive motor vehicle steering from a trusted resource.

You might qualify for a larger loan sum using a secured loan versus unsecured loans. Decreased common rates. Lenders ordinarily supply lessen rates for secured loans than unsecured ones. Downsides

Why It really is Great: Upstart's exceptional underwriting method considers education and work record, possibly benefiting younger borrowers or Those people with non-conventional credit score profiles.

Unsecured individual loans involve no collateral, which means you don’t must pledge a personal asset to safe the loan. However, Which means that lenders typically charge better interest rates and implement a lot more stringent qualification requirements.

Time for you to fund. Some lenders present rapidly personal loans with funding as brief as exactly the same working day while others might get up to some organization days to disburse your money. Consider how straight away you'll need The cash when making use of for just a loan.

Jordan Tarver has put in 7 decades masking house loan, personal loan and organization loan content for major economical publications like Forbes Advisor. He blends know-how from his bachelor's diploma in business enterprise finance, his experience like a prime performer from the home finance loan field and his entrepreneurial success to simplify complicated monetary topics. Jordan aims to make home loans and loans comprehensible.

Purchasing a vehicle is often an important expense, sufficiently big that it necessitates most people to consider out a car or truck loan. While not fairly as diversified since the vehicles they help finance, different types of motor vehicle loans can accommodate various purchaser desires.

Make 3X points on shipping along with other decide on business enterprise groups, plus 1X points on all other purchases built for your small business.

Car title loans and pawnshop loans can carry fascination rates that are very well previously mentioned typical in comparison with other types of secured loans, and if you fall short to repay them, you could possibly lose your car or your own assets held in pawn.

Whenever you consider out a secured loan, you enable a lender to position a lien from a little something you own in exchange for borrowing funds. Your asset presents the lender excess “security” that you choose to’ll repay the loan. If you default over a secured loan, the lender may take your asset and offer it to recoup the unpaid loan balance.

But if you're implementing for a business loan, home mortgage loan, or auto loan, you might be able to apply even without the need of an account. It's possible you'll uncover much better fascination rates at an establishment the place you have already got accounts.

In the situation of a secured small business loan, you would like read more to you should definitely Verify the necessities for a personal ensure. Although this exercise is rather widespread with equally secured and unsecured company loans, you don’t want to be taken abruptly.

A secured loan is one which is collateralized—or secured—by a precious asset, for instance real-estate, cash accounts or an auto.

Unsecured loans can be finest for borrowers who don’t have collateral to pledge for just a safe loan, and those with fantastic credit rating who will qualify for the bottom rates on unsecured loans. You will discover unsecured loans by way of banking institutions, credit history unions and on line lenders.

Tony Danza Then & Now!

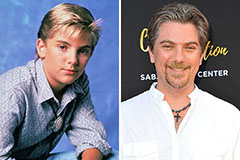

Tony Danza Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Marcus Jordan Then & Now!

Marcus Jordan Then & Now! Barbara Eden Then & Now!

Barbara Eden Then & Now! Megyn Kelly Then & Now!

Megyn Kelly Then & Now!